Harvest Credit

APIs connecting credit facilities to merchants, enabling seamless loan-powered purchases

Project Status

HARVEST CREDIT

SEAMLESS CREDIT AT CHECKOUT

Connecting merchants and lenders to provide instant credit options at the point of purchase

Overview

Harvest Credit is an API platform that connects credit facilities to merchants, allowing users to choose to pay through one of their listed loan providers directly at checkout. This eliminates the traditional multi-step process of applying for loans and then making purchases, creating a seamless experience for consumers while increasing conversion rates for merchants.

Instant Credit

Access multiple loan options at the point of purchase without leaving the merchant's site

Merchant Integration

Simple API integration for merchants to offer multiple financing options to their customers

Streamlined Process

Reducing a 6-step loan-to-purchase process to just 2 steps, improving conversion rates

The Problem

In Nigeria and many emerging markets, the traditional process of using loans for purchases is cumbersome and inefficient:

- Users must individually open each loan app to apply for a loan

- They wait for the loan to be disbursed into their bank account

- They then transfer the money to the merchant's account

This multi-step process creates friction, leads to abandoned purchases, and provides lenders with limited visibility into how their loans are actually being used.

Our Solution

Harvest Credit bridges loan/credit providers, payment processors, and merchants through a unified API platform. When a user is checking out on an e-commerce site, they can:

- Select "Pay with Harvest Credit" at checkout

- Choose from available loan providers they're pre-approved with

- Complete their purchase without leaving the merchant's site

The loan provider pays the merchant directly, eliminating the need for funds to first be disbursed to the borrower's bank account. This creates a win-win-win situation:

- For consumers: A faster, more convenient way to use credit for purchases

- For merchants: Higher conversion rates and average order values

- For lenders: Increased loan volume and better visibility into loan usage

Market Opportunity

Nigeria has a rapidly growing fintech ecosystem with approximately 250 fintech companies, yet none have built this specific product. The opportunity is substantial:

- Thousands of loans between $10 and $400 with interest rates of 5% to 15% are disbursed daily in Nigeria

- E-commerce is growing rapidly in the region, with consumers increasingly seeking flexible payment options

- Existing loan providers and payment processors can benefit from the interoperability Harvest Credit provides

Business Model

Harvest Credit generates revenue by taking 4% of the interest that loan providers receive on transactions facilitated through our platform. Based on market analysis, we projected potential revenue of $6,833 within the first three weeks of charging commissions.

Beyond transaction revenue, Harvest Credit collects valuable data on consumer spending behavior and patterns. Unlike the self-reported "reason for loan" data that lenders typically collect, our platform provides real-time insights on actual spending, creating additional value for our lending partners and potential for data monetization in the future.

Technical Implementation

The Harvest Credit platform consists of several key components:

- Merchant API: Easy integration for e-commerce platforms and retail point-of-sale systems

- Lender Integration: Secure connections to loan provider systems for real-time approval and disbursement

- User Authentication: Seamless verification of user identity across the platform

- Payment Processing: Secure handling of transactions between lenders and merchants

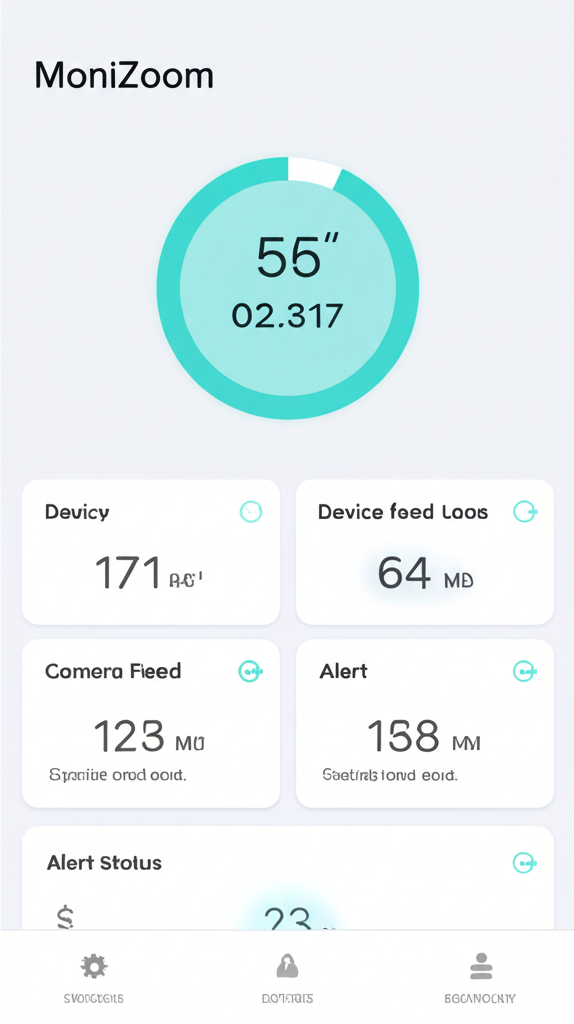

- Analytics Dashboard: Comprehensive reporting for merchants and lenders

Go-to-Market Strategy

Our approach to market entry focused on:

- Initial Partnerships: Securing agreements with key loan providers and e-commerce platforms in Nigeria

- Vertical Focus: Targeting high-value purchase categories like electronics, education, and home appliances

- Expansion Plan: Starting in Nigeria with plans to expand to other African markets with similar needs

Project Application

Harvest Credit was submitted as an application for startup funding. The application highlighted the unique value proposition, market opportunity, and potential for growth in the Nigerian fintech ecosystem.

Challenges and Considerations

Key challenges for the implementation of Harvest Credit included:

- Navigating financial regulations in Nigeria

- Building trust with both merchants and loan providers

- Developing secure systems for handling financial transactions

- Creating a seamless user experience across different merchant platforms

- Managing risk related to loan defaults and fraudulent activities

Future Vision

While Harvest Credit began with a focus on the Nigerian market, the concept has potential for broader application in markets where traditional credit access is limited but smartphone penetration is high. Future development could include:

- Expansion to additional African markets

- Integration with more types of credit providers beyond traditional lenders

- Development of a consumer-facing app for managing credit options across merchants

- Advanced data analytics to help lenders better assess risk and tailor offerings

Project Details

Role

Product Strategy & Fintech Consultant

Timeline

2020

Technologies

Status

Location

Lagos, Nigeria

Related Projects